What Is Mobilink Microfinance Bank Loan (Agricultural) 2023 in Pakistan?

After serving in the telecommunication sector Mobilink planned to serve Pakistan in a new and unique way in the field of agriculture. To accomplish this task they first launch their services in Mobilink Microfinance Bank in the year 2015. After that back in the year 2019, they introduced Mobilink Microfinance Bank Loan. It helps people to make their dreams come true in the right and easy way. But along with that they also offered Digital Banking Services, ATM cards, Debit Cards, Credit Cards, Cash deposits & Withdrawals. Similarly, they have also added insurance services to their list to serve in a better way to their users.

More Bundles: What Is Zong Advance Loan And How Much Balance It Add To My Prepaid SIM?

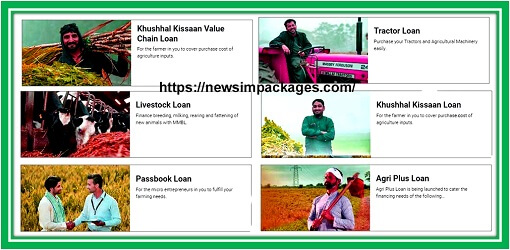

Here we will only discuss the Best Mobilink Microfinance Bank Loan types. As well as their terms and conditions. As well as the loan calculator to know the interest rates and how to apply for your desired loan. I want to tell you that there are mainly 17 different types of loan schemes introduced by the MMBL scheme.

No.1- Mobilink Microfinance Bank Agri Plus Loan Scheme 2023

Mobilink Microfinance Bank has introduced a very attractive offer for those who are working in the field of agriculture and livestock farms. Agri Plus Loan now helps to make the essential financial needs of the people related to this category. So those who are engaged in agricultural activities to grow crops or have livestock frames for breeding or fitting of animals. It helps the people for both starters with small and limited agricultural and livestock activities or the microenterprise scaled farmers too.

- Eligibility To Apply Online For Agri Plus Loan

Only those who have experience in agriculture farming and cattle farming of a minimum of 2 years can apply to get this loan. On the other hand, the applicant’s age must not be more than 64 years to apply online. You can get a loan amount of Rs 50000 to 350000 PKR in the general category. On the other hand in the Microenterprise category, you can apply to get a loan amount of 350001 PKR to 3000000 PKR.

Moreover, you can return the loan amount in monthly, three months, six months, or yearly installments. And you have to return all the amount in one year to two years time period. Lastly, the company also includes free credit life insurance for permanent disability and death insurance for the borrower free in this plan. If you are eligible and want to apply online for an Agri Plus Loan visit here.

No.2- Latest Tractor Loan Scheme

The farmers who own a minimum of 3 acres of agricultural land in any area of the approved locations can not apply for a New Tractor Loan Scheme. You can buy a new tractor or any type of land machinery with this loan which can provide you a cash amount of 350000 to 3000000 PKR. Most importantly an insurance fee of 1.40 % is also included in this scheme too.

-

Terms & Conditions For Online Apply Of Tractor Loan Scheme

People who are having experience of a minimum of 2 years or more are eligible to apply online to get an MMBL Tractor Loan amount. Their age must be between 21 to 60 years and must have a valid CNIC and also must not be defaulters to any institution. The loan amount is up to 50% of the tractor price or up to 300000 pkr. And you must pay the down payment of 10% to 50 % at loan approval. To pay the loan you have to pay it in half-yearly payments within 1 year to 10 years of time. So if you think you are eligible to get the Tractor Loan Plan then go ahead and apply online here.

No.3- Live Stock Loan Scheme

If you are a farmer and want to establish and invest in a livestock business to make extra investments. Mobilink Microfinance Bank loan schemes now allow you to apply for a livestock loan scheme 2023 to make all your business needs. You can get a minimum of 50K amount loan as well as you can get a maximum loan amount of up to 350000 pkr. It motivates the farmer to produce and helps the economy in the improvement of breeding, milking, rearing, and fattening of large-capacity animals like bulls, cows,s and buffalos of different species. To apply for a loan online visit here.

-

Eligibility Criteria For Live Stock Loan Apply Online

If your age is between 18 to 60 years and has a household income less than 1200000. And you have a valid CNIC with a minimum experience of 2 years in the specific field. Then you are eligible to apply for this loan. Which gives you a minimum loan amount of 50000 and a maximum of 350000. You have to return the loan amount within 6 months to one year 12 months. Most importantly, it also covers Free Credit Life Insurance for the person. As well as it also included Free Livestock Insurance too in case of any tragedy happens.

No.4- MMBL Khushaal Kisssaan Value Chain Loan Scheme 2023

Sometimes the farmers suffer a lot due to low revenue when they are growing their grains or vegetable. But mobilink microfinance bank has fixed this issue for you with the introduction of MMBL Khushaal Kissaan Value Chain Loan 2023 Scheme. This plan provides you the financial facility to cover and make the needs to grow your agricultural products easy. You can use this loan amount to buy seeds, pesticides, or fertilizers at any time. And you can easily return the loan amount when you sell your crops and grains at a good price in the market.

Terms & Conditions & Eligibility Criteria

You can only apply for a maximum loan amount of 75000 PKR if you are applying for the first time for this product. Meanwhile, after that, you can get up to 350000 PKR as a loan amount for six months only. In addition to this loan, insurance is also included in this product in case of any death or permanent disability of the loan person. A personal guarantee need for the approval of this product. And the age of the candidate must be between 18 to 60 years. And if you do not have an agricultural or relevant experience of two years or more you cannot apply for this plan. Lastly, you must not defaulter on any of the banks or any other institutions to get this loan too. So if you think you are eligible to get the MMBL Khushaal Kissaan Value Chain Loan program simply apply online here.

No.5- Pass Book Loan By MMBL

MMBL introduced one of the most famous and comprehensive Pass Book Loan programs back in the year 2015. Which is currently Pakistan’s top and best loan program and the most beneficial of all the other products by any financial institution. It helps a target group of people who required loans to make all their agricultural needs. Including farming, production, or development of your agricultural land and machinery or equipment. You can get a loan amount of 50000 pkr to a maximum of Rs 3000000 PKR. The processing time is only 7 days and you have to give back the amount within one year.

- Eligibility Criteria Terms & Conditions To Apply Online

You must have an agricultural experience of two years or more to be eligible to apply online. Must not be a defaulter to any financial institution or bank. And your age must be between 20 years to 63 years only. On the other hand, you must be living in the specific city within the approved branches for more than 2 years. The tenure of the loan is from 1 year to 10 years and it can be returned in six-month or yearly installments. It also includes the Mandatory Crops Loan Insurance in this program. So if you think that you are eligible to get Pass Book Loan you can apply online now.

No.6- New Khushhal Kissaan Mobilink Microfinance Bank Loan Program 2023

This product is only for the specific whole market to cover both agricultural activities as well as the livestock field. So you can get a loan amount of up to 50000 to 350000 PKR to make the needs of agricultural inputs, and accomplish tunnel farming needs. As well as you can also use this amount for livestock activities like milking, rearing, and fattening as well as trade in animal goods. The tenure of the loan is 3 months to one year 12 months only.

Terms & Conditions To Get The Loan

If your income is less than 1200000 pkr and your age is between 18 years to 60 years. Then you can apply to get khushhal kissaan loan scheme. On the other hand, you must be a resident of the current location within the approved areas for more than two years. And did not have and default history with any bank or any other private institutions. On the other hand at the loan approval, you must provide a business or job person guarantee. Most importantly, a loan insurance product is also added to this package. In case of any type of permanent disability or death of the applicant. So if you think you are eligible to apply for MMBL Loan Program 2023-24 apply online here.

More Best Packages: How To Block Unknown Numbers Calls SMS Mobilink Jazz Warid Telenor Zong Ufone Sims?